Blockchain: digital disrupter or dud?

Expert reviewers

Essentials

- A blockchain is a database in which every entry is verified and unchangeable.

- A common feature of a blockchain is that it is distributed, meaning no central authority has control over it. Instead, the database is held over potentially thousands of computers, and the information is shared and open to everyone.

- The transparent, trackable and shared nature of the blockchain makes it a trustworthy source of information and difficult to hack or corrupt.

- Blockchain technology was initially created to support the arrival of the digital cryptocurrency Bitcoin.

- There is great potential for blockchain technology to be used in fields outside the finance industry, though this is not yet fully realised.

In 2010 the financial world started to get both excited and terrified about a new peer-to-peer digital currency called Bitcoin. It didn’t take long, however, for people to realise it was the technology behind Bitcoin—the blockchain—that was even more revolutionary, with the potential to transform how we interact, do business and share information across multiple industries. Some within the industry believe blockchain technology will be as significant to modern-day life as was the arrival of the internet in the 1990s.

But potential is one thing, reality is quite another … so what is a blockchain, how do blockchains work, what could they do, and can they really live up to the immense hype that’s been heaped on them?

Blockchain basics

At its simplest, a blockchain is a database. That’s not something people typically get excited about, so why all the interest? Well, there are several important aspects of a blockchain that make it very different from your standard, everyday databases. Let’s take a look:

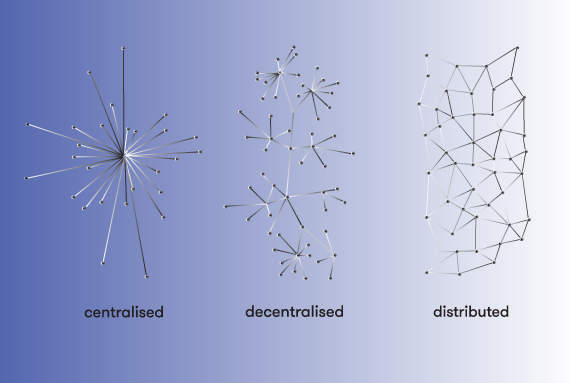

Distributed

A blockchain is a type of distributed ledger. This means that the entire database—and every piece of information in it—is simultaneously distributed across a whole network of nodes (computers), spanning multiple sites, countries and even continents. Digital data is automatically shared, updated and replicated to users, which in turn works to establish an agreed consensus of the ledger’s contents.

There are several benefits to a distributed ledger:

- there is no central authority with control over the database, and therefore no single point of failure (such as from a cyber-attack, mechanical glitch, human error, business failure or deliberate censorship)

- it is very difficult (though not impossible) to make unauthorised modifications or deliberately tamper with the information, because everyone in the blockchain network would immediately become aware of changes to the ledger

- a higher level of trust can be established because the algorithms that secure and update blockchain information mean all users can be assured their ledgers match over time

- more efficiency is achieved due to the removal of the need to reconcile many different ledgers, which is expensive, time consuming and error prone.

This is very different to typical databases, which are generally held on a single computer, kept relatively private and managed by a sole organisation. It’s a strange concept that the more people who have access to a database, the more secure it is. This is because most people intuitively think that it’s confidentiality that ensures security. When it comes to blockchain, however, it’s the integrity, rather than the confidentiality, of the system that guarantees its security. This integrity is precisely why The economist dubbed blockchains as a ‘trust machine’.

Peer-to-peer

One of the most exciting benefits of a blockchain is that it essentially removes the need for a middleman to mediate or verify transactions. Currently, for example, if you send funds electronically between yourself and a second party, your bank has to verify that you have the money to send and release the funds, while the receiver’s bank has to then verify that it has arrived. This can take several days, and often incurs a fee. With a blockchain, the funds would go straight to the second party, with users of the blockchain technology doing the verification. There is still a small fee to pay here (for example if using the Bitcoin system), though this is generally much cheaper than a typical money transfer.

And it’s not just money that can be sent via a blockchain. Contracts (known as ‘smart contracts’) could be exchanged between parties. Set conditions can be programmed into the contract, and when those conditions are met, aspects of the contract (such as the release of funds) would execute. These smart contracts are not necessarily legally binding, and any contract of importance would still require the input of a lawyer—though now your expensive lawyer also needs to know how to program! Currently however, for smart-contract transactions, execution on blockchain is more expensive than execution of equivalent code on conventional cloud technologies; blockchains aren’t always the cheaper or faster option.

Essentially any activity—an agreement, contract or transaction—that needs to be verified and recorded has the potential to benefit from blockchain technology. If you think of all the industries that currently rely on middlemen to get things done, you can begin to imagine the impact blockchain technology could have.

How does it work?

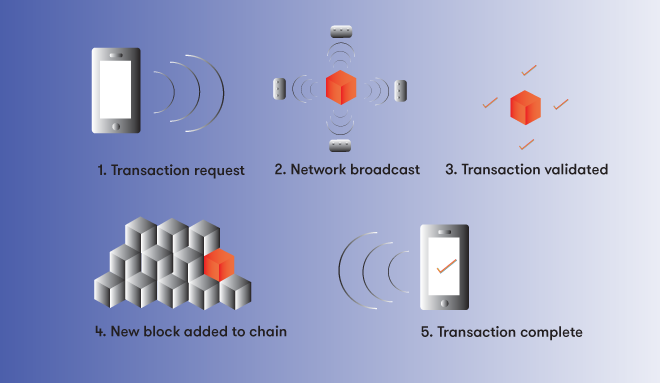

The transaction data stored in a distributed ledger on a blockchain are chunked into sequence blocks, just like a traditional ledger is a sequence of pages in a book. The blocks are connected by a strong mathematical guarantee using a construct known as a one-way function. The specific function used may vary between different blockchains but typically they use something called a cryptographic hash function, which forms a kind of digital fingerprint. What is special about these hashes is that they are astronomical numbers that uniquely reflect the content of the block—just like your fingerprint is unique to you. Blocks must contain the hash (fingerprint) of the previous block, forming a chain. If a user attempts to publish a block that doesn’t strictly follow all the mathematical rules, the other nodes on the network will automatically ignore that block.

Every transaction within the blockchain is recorded including, typically, the time, date, participants and value of the transaction. This ‘block’ is then verified across the whole database network, and can be seen by everyone, so it can’t be reversed or altered in any way. To change one block would essentially entail having to change all subsequent blocks.

The simple consensus protocol principle (that the first announced valid block is considered correct) ensures that every node in the system continuously and automatically agrees with every other node about the details in the ledger and every transaction contained within it.

Invalid transactions are also not allowed because that would violate the accounting rules defined for the blockchain that every node is constantly checking. Those accounting rules are defined in the source code of the blockchain, and accepted by informal social conventions within the community. Nodes won’t accept invalid transactions because they know the rest of the community would also not accept them in the consensus.

So on most blockchains, every transaction is public, and every node (potentially tens of thousands) unanimously agree that a valid transaction has occurred between X and Y at this time for this much value. It’s like having a notary present at each transaction.

Public vs. private blockchains

While the Bitcoin blockchain is the most well-known, there are now thousands of blockchains around the world being used across multiple platforms and industries. The code was released in 2009 as open source software allowing anyone to use the computing architecture to create their own blockchain system. These alternative blockchains can then set their own controls and rules—such as public/private permissions, different economic policies, different hash algorithms, and so on.

Although the theory behind the original blockchain (Bitcoin) was decentralisation and open access, private blockchains also exist. Being a blockchain, it would still be distributed, but to a much smaller group of participants who have been given permission to access and assess the information contained within it. These private or semi-private blockchains are preferred by some organisations and institutions, such as banks, which may want to keep a level of control over who views specific information, or which have regulatory constraints on whom they transact with.

Due to their smaller size, these private blockchains can be faster than public blockchains, and can have consensus algorithms with properties that are a better fit with conventional databases.

Potential future applications

While originally focused on the domain of finance, there is great potential for blockchains to influence a host of other sectors. From banking to real estate, government to health, many industries are closely monitoring and undertaking initial testing of its potential. William Mougayar, author of The business blockchain, describes the years 2015–18 as blockchain’s ‘installation phase’, and from 2018 onwards as its ‘deployment’. He believes that ‘every company is destined to own or participate in a variety of blockchains, whether they are private, semi-private or public’.

As mentioned earlier, almost any activity (an agreement, contract, transaction) that needs to be authenticated has the potential to benefit from blockchain technology.

Some of the applications for blockchain technology seem like a natural fit, for example:

Financial records—currency, bonds and equities

Public records—land titles, business licences and birth certificates

Private records—medical and accounting records, contracts, wills and trusts. Estonia is already using technology in this area, asking its citizens to check their government records via the use of distributed ledger technology.

Semi-public records—certifications

Physical—package delivery

Intangibles—patents, vouchers and copyrights.

But there are also more unusual possible applications that are being explored, including:

Voting and legislation—voters receive digital tokens that allow them to vote, for example in a corporate setting (new board members), in an election, or on a specific bill, law or issue. Each vote token can be sent only once, preventing double-voting; votes are permanently recorded; and voters can participate from anywhere with internet access. Using cryptography, voter identities remain hidden. One current issue with using blockchains for voting is that during the voting period it is difficult to hide results-to-date. This can lead to strange strategic voting behaviours. For example, if a voter can see that a ‘yes’ vote is in the lead, they may be disinclined to vote ‘no’, or may work to persuade or influence more ‘no’ votes.

Digital identity—as our lives become increasingly digitised, the potential of blockchain technology to manage, track and keep our digital identity secure becomes increasingly important. Forget your old, easily hacked ‘1234’ password, blockchain-based authentication would employ identity verification through the use of public key cryptography. Users receive two digital ‘keys’—a public key, which can be used to view the transactions and account balance of an address, and a ‘private key’ which is your unique code to access information. Both keys are needed to make transactions. As with anything this is still not 100 per cent foolproof, as there is always the possibility your private key code will be stolen or impersonated.

Tracking … well … everything—from bagged lettuce leaving a farm in the UK to blood diamonds taken from conflict zones, blockchains are being trialled—and in some cases are already operating—to track the journey of an item from beginning to end. The full history of products and produce could be traced from point of origin to packing, shipping, inspection and point of sale. This information could be made visible to all parties, including relevant industry watchdogs and regulators—for example in the case of food contamination outbreaks or to certify diamond ownership.

Do blockchains have any disadvantages?

Like all new innovations, there are still a lot of unknowns about blockchain technology and how it may work in real-world scenarios. There are several key issues that need to be resolved before it becomes fully mainstream.

Scalability

Scalability can be defined as a system’s ability to deal with an increasing volume of work, or its capability to be enlarged in order to deal with that growth. The Bitcoin technical community, for example, is currently working through a few specific scalability issues arising from the sheer size of the (continuously growing) database. How big is too big (in terms of things like storage capacity for users and energy use) before it becomes too difficult to manage?

Another issue the Bitcoin blockchain is working through is that the number of possible transactions per second (tps) is low. Bitcoin can achieve less than seven transactions per second, while some of the major credit cards are capable of more than 2,000 tps. The long-running ‘block-size debate’ is a discussion about the right amount of data that should be permitted in a single block. If it’s too small, the number of transactions that can fit in a single block will be so few that transaction fees will likely rise and Bitcoin will only be economical for high-value transactions. If it’s too large, the potential time delay from transmitting much larger blocks around the network will mean that users will need an expensive high-performance internet connection in order to participate.

While less of an issue for smaller blockchains, scalability of blockchain software is something that needs further engineering research.

Integration

The potential changes wrought by blockchain technology will require a full revamp of existing markets and industries. How will these industries adapt and change? Even at the most basic level, industries will need to alter their legacy and record-keeping systems, and rewrite or update their terms and conditions, user agreements and policies on data management. This will all take time, money and commitment as well as (in the short term at least) disruption and, potentially, delays. However, the long-term benefits are expected to outweigh the short-term negatives.

Government and industry regulation and legislation will also need to adapt and keep pace to ensure appropriate legal safeguards are in place without compromising the potential of the technology. At present, legal frameworks have often lagged behind digital advancements, as can be seen in the music industry’s response to digital streaming, or the application of defamation laws in the age of the internet post.

Public trust

How would you feel knowing all your medical records or financial transactions were available on a decentralised database (albeit one that used strong encryption technology)? Even though much of our personal information is already digitised, it will take time for the public to understand and come to trust the new blockchain technology, and to actively participate in it. As much as we claim to dislike banks and government red tape, there is often a sense of security attached to the use of these established organisations. The speed at which the public begin to understand and therefore accept blockchain technology (and Australia is generally a fast-adapter to new technologies) may in part determine the success of blockchain uptake more broadly.

Security

Despite the many security features and controls of blockchains, they are by no means 100 per cent secure. While a transaction added to the blockchain is (at present) almost unalterable, the technology is young and hackers are no doubt attempting to find ways to corrupt the system. As the saying goes, ‘if you build a better mousetrap, Mother Nature will build a better mouse’.

Similarly, like stolen passwords, if a user’s private key for their blockchain account fell into the wrong hands (by user fault or malicious intent), transactions could be conducted on their behalf. This is a problem because, while you can change a password, you cannot change your private key. You would have to create a whole new account (that is, a new public/private keypair), and then somehow get everyone to accept your new account.

Can blockchains live up to the hype?

With so much talk about blockchains and their potential, it’s easy to see why so many people have been caught up in the excitement. It’s true that the technology holds a lot of possibilities to streamline processes, reduce costs, bypass third parties and improve transparency. This, and the fact that the open-source code allows the programming to be altered to record virtually anything of value (votes, birth certificates, land titles), gives it great scope to grow and develop to suit a range of needs across multiple industries.

However, as the enthusiasm settles, many industries may realise that they don’t really need to implement the technology at all, or that it doesn’t meet their needs. Steve Wilson, writer of the report Beyond the hype: understanding the weak links in the blockchain notes that ‘blockchain is neither necessary nor sufficient for many of its suggested applications; in practice, it’s massively over-engineered, or incomplete, or both’.

Current-day blockchains have been likened to what the web was in the mid-nineties. They are there, they sort-of work, but people don’t yet know how to fully use them effectively in a commercial capacity.

It remains to be seen whether the technology really can do what many people claim it can. The reality will probably be that some of the suggested claims will be disproven, while others will be expanded on and improved beyond our imaginings. We’ll just have to wait and see.

Where to from here?

There can be no doubt that blockchain technology has re-energised thinking about what is possible with the way we use, access and control digital information and assets online. For this reason it’s been labelled a ‘disruptive technology’, though whether it results in a positive or negative disruption remains to be seen—and may depend on which industry you’re in.